Unlock Your Business Potential: 10 Payment Methods for Success

In today's fast-paced world, choosing the correct payment methods can make or break your business. Here, we're exploring 10 powerful payment options that can enhance customer experience and boost your bottom line. Learn why it's important to maximize your business potential with smart payment strategies.

Multiple Payment Methods Matter

Simply, payment methods involve money transfers between one party and another in a business-to-business or business-to-consumer transaction. Commonly accepted payment options include cash, credit and debit cards, gift cards, and mobile payments. There are others, and each type offers unique benefits to both parties.

Offering and implementing diverse payment options significantly enhances customer convenience and minimizes checkout friction, ultimately preventing lost sales. When you also improve security and reduce fraud risks, you provide your business and customers with a safer transaction process. While both of these are important to the infrastructure of your business, embracing modern payment trends keeps your business competitive, relevant, and convenient. The bottom line is that offering your customers multiple options can increase satisfaction and loyalty. Customers with the flexibility to choose their payment method are more likely to complete their purchases and return for more.

Top 10 Payment Methods for Businesses

Credit & Debit Cards – Credit cards allow customers to make larger purchases (buy now and pay it off), which helps increase sales. Debit cards provide the same convenience for paying but help the customer better manage their spending.

Either way, credit/debit cards are the most widely used payment option because they offer convenience, reliability, and familiarity.

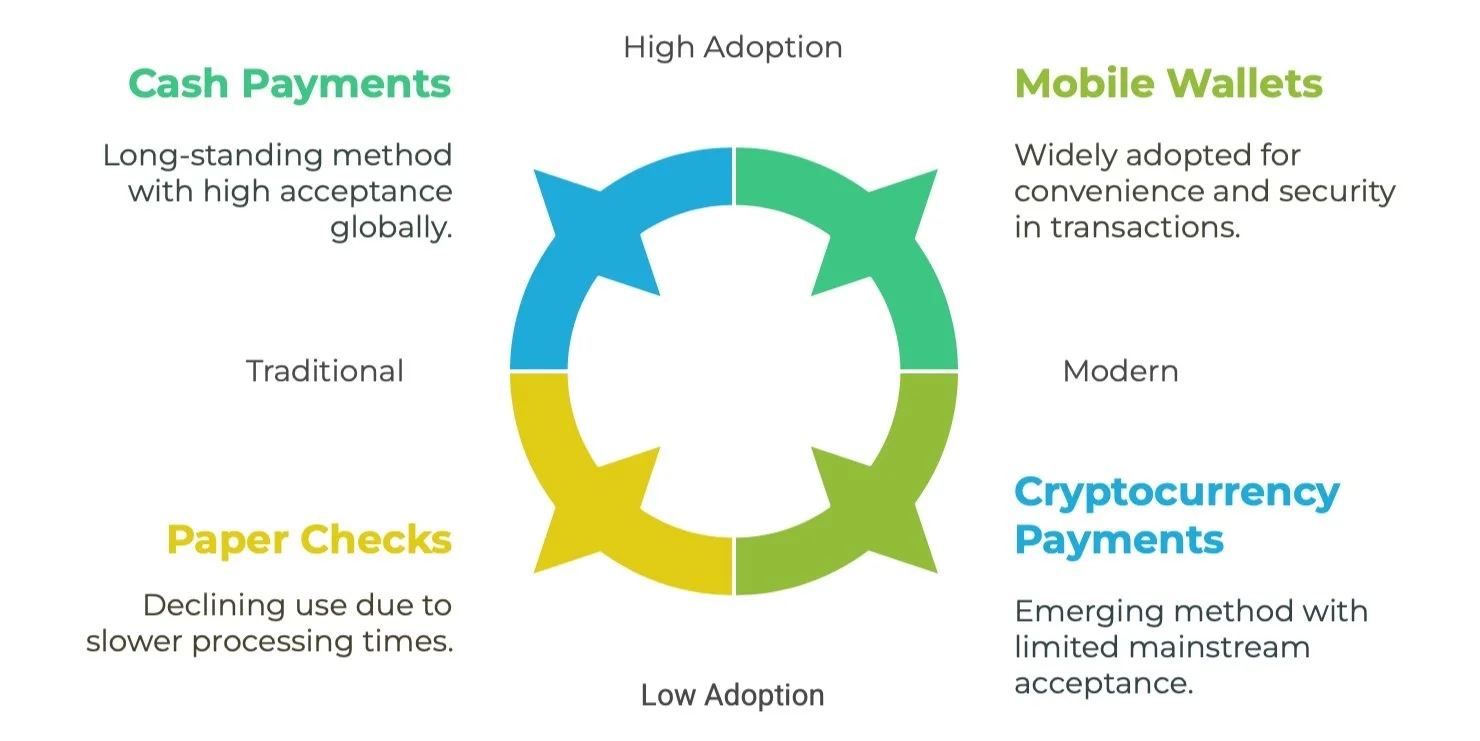

Mobile Wallets (Apple Pay, Google Pay, Samsung Pay) – Tap-and-go payments for faster, digital checkout experiences. These methods offer the customer convenience (quick smartphone payments) and enhanced security through biometric authentication. Growth in mobile payment spending is expected to triple by 2032, not adopting this method is no longer an option.

Digital Payments & eChecks – Online payments through ACH and electronic checks. Digital payments (electronically transferred funds) are gaining popularity because they are efficient, convenient, and offer more security. They are suited for large transactions and typically minimize fees. eChecks are a digital version of a paper check, which makes it efficient and reduces payment delays.

Buy Now, Pay Later (BNPL) – Allows customers to pay in installments if the provider qualifies the customer. BNPL is a controversial method of payment but is growing in popularity. BNPL allows customers to purchase something and pay in installments, adding flexibility and convenience to the consumer. Services like PayPal, Affirm, and Afterpay enable customers to apply (or be preapproved) for this service. While this can be a great way to boost sales and attract customers, there are downsides to the consumer for debt accumulation. Businesses should protect themselves by being extraordinarily clear in their terms and conditions of using a BNPL service to help their customers make informed decisions.

Cash Payments – The traditional payment method that still accounts for a large portion of in-person transactions. Cash still accounts for up to 30% of all transactions. In some sectors, the passing on of transaction fees to the consumer, the cash usage number is even higher. Almost 20% of consumers still prefer cash as a payment method. Handling cash is hands-on and requires diligence by the business and its employees.

Bank Transfers – Ideal for large transactions and business-to-business payments. It is pretty straightforward and a typical method for transferring funds from one bank to another. Not typically used for business-to-consumer transactions.

Cryptocurrency Payments – Growing in popularity for international and digital transactions. Without explaining how blockchains and decentralized networks work, the simple takeaway is that using cryptocurrency as payment allows for easier, faster, and more secure global transactions. The biggest thing to be aware of is the price volatility and the everchanging regulations surrounding cryptocurrencies as this relatively new technology evolves.

Contactless NFC Payments – Quick, secure transactions using smart cards and mobile devices. Gaining popularity, this technology uses safe, low-speed radio frequencies to make the transaction in seconds. This convenience can enhance customer loyalty and satisfaction.

Biometric Payments – Fingerprint and facial recognition payments for ultimate security. This is a payment method that is anticipated to explode in popularity through the end of this decade and is expected to expand almost 120%. Biometric integretaions are already present in smartphones and other daily, personal use technology. This type of payment provides increased security and all the benefits of speed and convenience.

Money Orders & Paper Checks – Still relevant for specific industries and older demographics. These methods have the least security and the lengthiest end-to-end payment process. However, some business models should still consider offering this based on their business type and demographic.

Nearly 90% of U.S. consumers* use contactless payment methods, highlighting the apparent shift towards convenience,and the expectation that they are secure payment options.

*Forbes (2024) Contactless Payments: How It's Disrupting the Way Payments are Made

Steps to Accept Payments On-line and In-store

Choose Merchant Services Provider

Set up a secure payment gateway

Choose a POS system for in-person transactions

Offer multiple payment options

Ensure PCI compliance to protect data

Harness the Expertise of a Payments Consultant

The payments industry is significant, with rules and updates that are constantly evolving. The best way to optimize your payment processing success is to leverage the expertise of a Merchant Solutions provider. These providers can help businesses offer various options that best suit their needs to enhance client satisfaction, improve revenue, reduce costs, and streamline transactions—all part of a recipe that keeps customers coming back for more. PayStream, for example, is a Merchant Services provider that can assist businesses in evaluating, selecting, and implementing the infrastructure needed to support the most suitable payment methods for the business. Partnering with PayStream or a company like it helps businesses meet their goals and customer expectations.

Parting Thoughts

Offering multiple payment methods is essential for your business. You can't afford not to pay attention to your payment processing choices. Now more than ever, who and what you choose to handle the financial transactions of your business can make or break your sales and revenue goals. Leveraging the expertise of payment consultants like PayStream, evaluating fees and costs, having the most up-to-date equipment and software, and a product or service enhancing menu of payment options for your customer can enhance customer satisfaction, increase sales and revenue, and reduce fraud risks. Focusing on and promoting various payment methods will improve the customer experience and keep your company ahead in this fast-paced digital world.

Ready to Optimize Your Payment Strategy?

Offering multiple payment options is no longer optional—it's a necessity. Contact PayStream today for expert guidance on integrating the best payment methods for your business. Schedule Your Free Consultation Today!

FAQs About Payment Methods in 2025

What are the most popular payment methods for businesses?

In 2025, businesses will widely use credit/debit cards, mobile wallets, and Buy Now Pay Later (BNPL) options, which will offer convenience for customers and may increase sales.

What benefits does offering multiple payment methods provide?

Providing multiple payment options increases customer convenience and satisfaction, inspires and increases customer loyalty, boosts sales potential, and enhances transaction security. It ensures that customers can pay using their preferred method, which has been shown to increase transaction totals and reduce abandoned purchases.

How can a Merchant Services provider help my business?

A Merchant Services provider can streamline your payment processes by implementing diverse and efficient payment solutions tailored to your business needs. Their expertise can enhance customer satisfaction, reduce costs, and improve revenues and overall efficiency.

What should I consider when choosing payment options for my business?

When selecting payment methods, consider customer preferences, transaction fees, and security features. Also, consider how well or if they will integrate and work with your existing systems.

What kinds of future payment trends should I be keeping an eye on?

Emerging trends such as cryptocurrencies, contactless payments, and biometric authentication are shaping the future of payments.